Evolutionary economics Part 2 – Within and between

Evolution has infused life with economic principles–not just in individual cells and in organisms’ relationships with each other, but also within organisms, and between the members of entire societies

(Part 1 is here.)

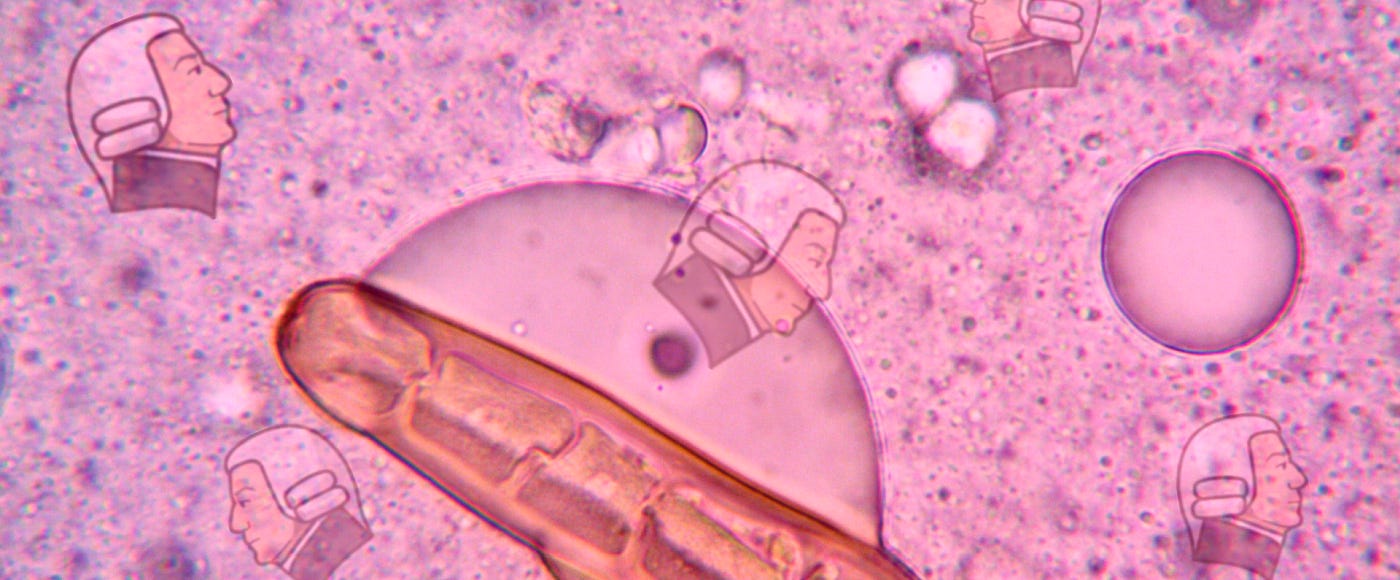

By some accounts, economic principles are almost as old as life itself. Mutations that enabled organisms to deal more efficiently with scarcity became persistent adaptations. Bacteria evolved adaptations using opportunity cost to maintain vital processes, plants and fungi developed nutrient exchange networks, and insects evolved specialized castes embodying division of labour. These examples, however, only illustrate how these principles apply to individual cells or between organisms. This post examines the more intricate coordination systems operating within organisms and between members of entire populations.

Economies within

We have seen how individual cells have components that specialize in particular activities, but in multicellular organisms, this is taken a lot further. Our body must maintain (almost literally) countless simultaneous transactions, all of which boil down to the constant redirection of resources, balancing dynamic priorities ranging from imminent threats to long-term investments.

Much like an organizational manager, an organism must deploy resources to serve long-term goals. Vertebrate brains exemplify this: human brains represent only 2% of body weight but are voracious consumers of oxygen (20% of our total intake), channelling this scarce resource to areas of highest demand. When reading or solving problems, neurons in active brain regions signal nearby blood vessels to increase blood supply—a process known as neurovascular coupling.

Wherever cells are active – from circulatory and respiratory to musculoskeletal and immune systems – they need oxygen for energy production. Each one 'bids' for resources (much like a budgeting process) through a sophisticated communication mechanism combining fast, localized neural control (through the hypothalamus, which integrates signals and prioritizes energy distribution) and slower, sustained hormonal signalling (via substances like insulin or cortisol).

This inner body economic system rivals a multinational company with both centralized control and decentralized operations. Core to managing this complexity is homoeostasis — maintaining optimal steady state conditions — comparable to economic equilibrium where supply and demand balance out. To achieve and maintain it, our bodies apply economic concepts like resource allocation, opportunity cost and trade-offs masterfully. The endocrine and immune systems enable it to balance the energy allocation between maintenance and reproduction or growth, and between both these long-term investments and immediate needs. During an infection, for example, the immune system claims extra energy at the expense of other functions (including cognition – we are usually not our sharpest self when we are ill). This is similar to how companies divert funds from expansion to crisis management.

Vertebrate bodies also take out insurance against future risk. One example is the maintenance of reserves of fat and calcium (in bones) as an insurance policy against the risk of future scarcity; another is the creation of memory cells as a result of an infection, to help avert a new infection with a pathogen encountered before.

These examples illustrate how dynamic interactions within organisms follow economic principles. However, the evolution of these adaptive mechanisms for resource allocation, trade-offs, and risk management did not stop here, but continued scaling across all levels of biological organization.

Economies between

Social groups—from ant colonies to primate communities—have similarly evolved complex exchanges to coordinate effort, distribute resources and pool risk while balancing individual and collective needs. Cetaceans hunt cooperatively, with individuals 'investing' effort without immediate personal gain. Orcas coordinate to create waves or tilt ice floes to capture seals, while bottlenose dolphins adopt specialized hunting roles: 'drivers' herd fish toward 'barrier' individuals blocking the prey’s escape.

Fish shoaling can also be seen as an evolutionary adaptation that acts much like a risk pool: even though some will be caught by predators, every individual is on average safer as part of the shoal. Moreover, positions within shoals have different values in this biological 'safety market' – central positions offer greater protection and are therefore more 'expensive' in terms of the energy expended to maintain them and the social requirements to occupy them. Research suggests fish with heightened risk perception invest more to occupy these premium central positions, much like how humans pay premium prices for a house in a safer neighbourhood.

Still under water, Octopolis and Octlantis, two octopus 'settlements' off New South Wales, show remarkably complex social behaviour otherwise seen only in vertebrates. The animals exhibit territoriality, with occupants of a den 'investing' in their property by collecting shells and other materials to modify their shelters, then defend this investment against intruders—fundamental features of property economics.

Above the water, territoriality is more common and often indicates sophisticated economic organization. Different bird species may share horizontal territory but divide it vertically (much like humans in flats). Blackbirds, primarily ground feeders, protect their 'property' not just from conspecifics but also from other competitors for the same resources like song thrushes, while ignoring canopy feeders like nuthatches. The intensity of their territorial defence effort – song and patrolling – reflects resource scarcity and intrusion frequency, a sign of bird cost-benefit analysis.

Packs of wolves also carve out their territories “economically”. Their territory size reflects prey density, pack size, and its efficiency at hunting. As they proactively allocate resources to defend their territory (through scent marking, vocalizing, and physical confrontation), this ensures an optimum balance between feeding needs and required defence effort. Nature, like human economics, rewards efficiency.

Within animal societies, to paraphrase George Orwell, some animals are more equal than others. Status often confers economic (and reproductive) benefits, and thus drives social behaviour. Crows, for instance, can solve problems (e.g. using objects as tools to extract food from difficult places), recognize threats and warn others, and protect resources through deception (pretending to hide food in once place while secretly storing it elsewhere). These practices clearly serve the flock, which rewards the contributing individuals with status that grants them better access to food and social protection.

These natural economies represent a profound evolutionary innovation—coordinating resource allocation across complex systems. While a bacterium determines which proteins to produce, our bodies coordinate resources across trillions of cells simultaneously. Similarly, complex animal societies with specialized roles, dynamic labor allocation, and distributed decision-making represent a significant leap toward human economic complexity.

The final part of this series looks at how human economics is very much an extension of three billion years of evolution, often paralleling or replicating natural market mechanisms and the economic principles that guide it.

Uncle Dory here.

Koenfucius, what a marvellous piece—part microscope, part market metaphor, and all woven with curiosity. I raise my mossy mug to you.

That said… I feel a nudge coming on.

Yes, cells coordinate. Brains bid. Shoals redistribute risk.

But let’s not mistake that for capitalism with gills.

What you’re pointing to isn’t economics—it’s life being itself.

And life doesn’t run a market.

It runs a metabolism.

The forest doesn’t externalise its costs.

Octopuses don’t hoard.

Birds don’t file quarterly reports.

In its best moments, economics is a clumsy tribute to these deeper logics.

In its worst moments, it forgets where the tribute came from.

So what if we flipped the metaphor?

Not “How is nature like an economy?”

But “What might our economies become if they re-learned from nature?”

Would we optimise, or metabolise?

Extract, or entangle?

Maximise, or compost?

You’ve opened the door to that question. I want to help hold it open.

Let’s let the metaphor rot a little and see what new shoots emerge.

Warmly,

Uncle Dory

(Relationally retired, metabolically employed)

Good piece

The universe is always transactional, and this applies to economics too. Nature shows us this.